The article titled “7 Strategies for Effective RAF Risk Adjustment in Healthcare” primarily focuses on outlining strategies that healthcare organizations can implement to optimize their RAF risk adjustment scores. It highlights the critical importance of:

These measures are essential for improving compliance and financial outcomes, ultimately ensuring that healthcare providers secure appropriate funding from Medicare Advantage plans.

In the dynamic landscape of healthcare, optimizing Risk Adjustment Factor (RAF) scores is of paramount importance. Organizations must navigate the complexities of coding and reimbursement, and advanced tools such as the Inferscience HCC Assistant are emerging as transformative solutions. This innovative tool revolutionizes the coding process through automation and real-time data analysis, alleviating administrative burdens on healthcare providers and enhancing coding accuracy. Consequently, organizations can maximize their funding from Medicare Advantage contracts.

With the integration of artificial intelligence and natural language processing, the HCC Assistant streamlines workflows and addresses challenges like data silos, ultimately leading to improved patient care outcomes. As the healthcare sector continues to evolve, understanding and leveraging these advanced technologies will be critical for organizations striving to enhance financial performance and ensure compliance in an increasingly competitive environment.

The Inferscience HCC Assistant revolutionizes the programming process by automating the collection and analysis of clinical data. By delivering real-time coding recommendations directly at the point of care, this groundbreaking tool empowers providers to significantly enhance their RAF risk adjustment scores. This automation alleviates administrative burdens, allowing providers to concentrate more on patient care while optimizing funding from Medicare Advantage contracts.

The integration of artificial intelligence and natural language processing within the HCC Assistant not only streamlines workflows but also guarantees a higher level of accuracy and efficiency in coding, which are critical elements for maximizing RAF risk adjustment scores. Furthermore, the HCC Assistant addresses the prevalent issue of data silos in healthcare. By seamlessly integrating with electronic health records (EHR), it consolidates individual data into a single repository, thereby improving the accuracy of RAF risk adjustment processes. This capability is vital for boosting programming efficiency and minimizing errors, ultimately leading to enhanced patient care outcomes.

The HCC Assistant employs advanced algorithms that assess clinical documentation and recommend appropriate codes, ensuring that providers capture all relevant diagnoses and procedures.

As AI technology continues to advance in the medical field, its integration into coding practices is expected to become increasingly indispensable, with industry leaders recognizing its potential to enhance operational efficiency and compliance. The recent investment of $150 million by Caption Health to develop AI-guided ultrasound technology highlights the growing commitment to AI advancements in healthcare, underscoring the necessity of adopting sophisticated tools like the HCC Assistant.

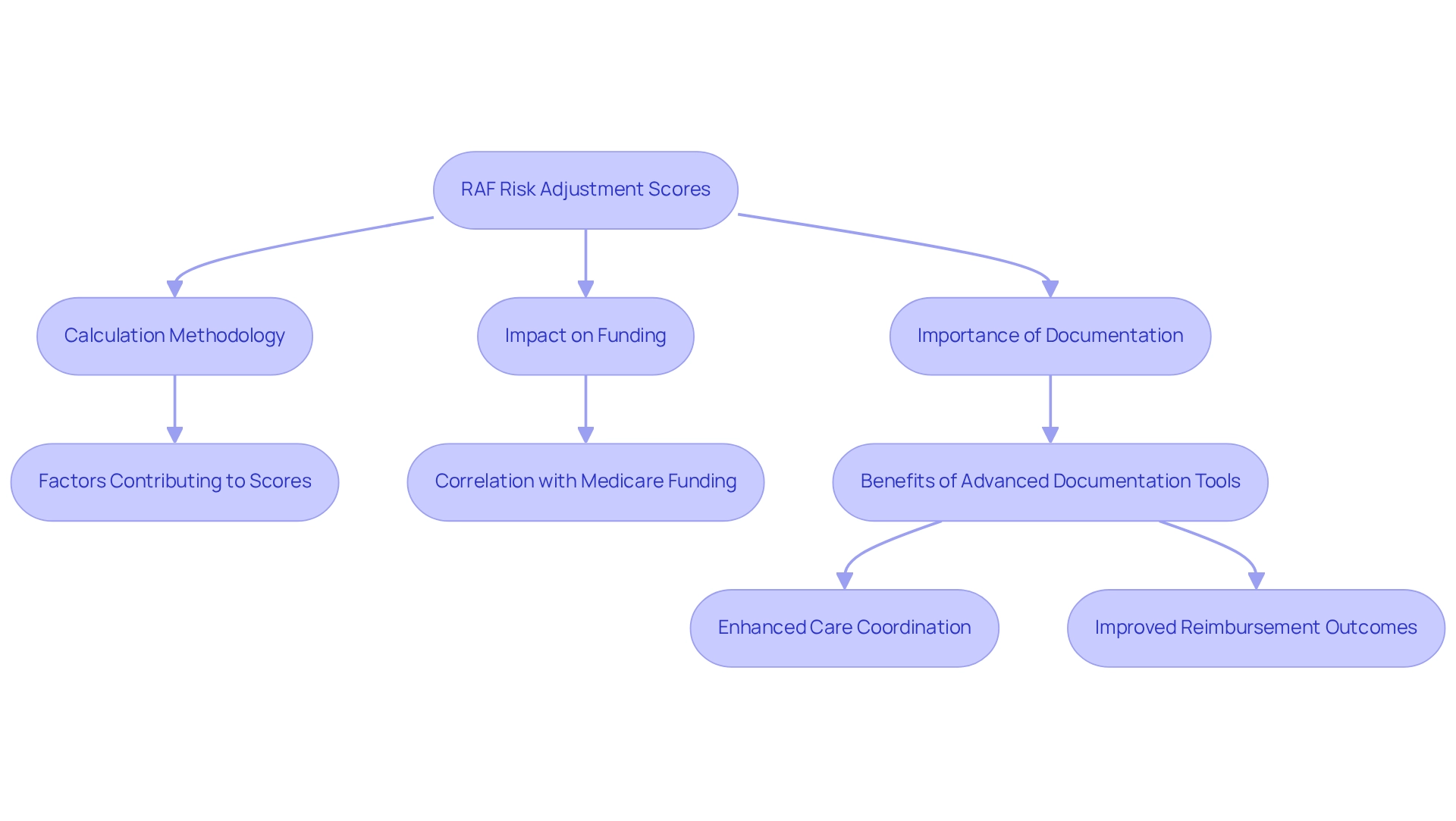

RAF risk adjustment scores are crucial indicators for estimating the anticipated medical costs associated with Medicare beneficiaries. These scores derive from a combination of individual wellness status and demographic factors, enabling medical organizations to secure appropriate funding. A comprehensive understanding of RAF score calculation and its financial implications is essential for medical providers. Higher RAF risk adjustment scores signify a greater expected cost of care, which directly correlates with increased funding from Medicare Advantage plans. Therefore, accurately documenting diagnoses and conditions is crucial for optimizing these scores related to RAF risk adjustment and ensuring the financial sustainability of healthcare organizations.

In 2025, RAF scores will be calculated using a refined methodology that encompasses a broader range of clinical data, highlighting the importance of precise documentation practices. Organizations leveraging Inferscience’s advanced tools have reported notable enhancements in their documentation processes, which are vital for addressing care gaps that can adversely affect patient outcomes. These advancements not only reduce the risk of upcoding but also bolster adherence to Medicare Advantage Star Ratings, ultimately leading to improved reimbursement outcomes. As Katia Arteaga articulates, “This integration strengthens provider-payer collaboration by streamlining risk adjustment, improving RAF accuracy, and enabling timely clinical interventions that enhance care coordination and reimbursement.”

The implications of RAF scores extend beyond mere funding; they are integral to medical financial management. As medical organizations aim to optimize their RAF risk adjustment scores, they can leverage Inferscience’s smart EHR tools to effectively capture patient complexity, thereby addressing potential care gaps. This strategic approach not only enhances care coordination but also fortifies provider-payer collaboration, ensuring that medical providers receive the funding necessary to deliver quality care. With the final submission deadline for services rendered in 2023 set for January 31, 2025, timely and accurate RAF score management utilizing Inferscience’s solutions is more critical than ever for financial viability in the medical industry.

Adhering to regulatory standards presents a significant challenge in RAF risk adjustment for medical organizations. Navigating the intricate regulations established by the Centers for Medicare & Medicaid Services (CMS) is crucial to avoid penalties and secure accurate reimbursements. In recent years, healthcare organizations have faced substantial penalties due to classification inaccuracies, underscoring the importance of strict adherence to guidelines for accuracy and documentation practices.

For instance, the overall payments linked to high-risk diagnosis codes for Humana from 2017 to 2018 amounted to $642,816, highlighting the financial repercussions of compliance failures and the urgent need for effective compliance strategies related to RAF risk adjustment. To uphold compliance and enhance the precision of RAF risk adjustment scores, organizations should implement regular audits and continuous training for personnel involved in documentation. Effective compliance programs integrate individuals, procedures, and tools, not only improving accuracy but also fostering a culture of accountability within organizations.

For example, organizations can utilize Inferscience’s HCC Assistant, a coding tool designed to streamline audit workflows and bolster coding accuracy through advanced natural language processing (NLP) and intelligent rules. This tool aids in identifying overlooked health diagnoses, ensuring providers maximize funding from Medicare Advantage contracts while allowing them to concentrate on patient care.

Additionally, leveraging data-driven strategies, as observed in the life sciences sector, can provide organizations with a competitive advantage in compliance. By aligning information and employing advanced technology, service providers can mitigate concerns associated with regulatory scrutiny. Furthermore, insights from independent medical review contractors assessing compliance with Federal requirements can guide organizations in refining their coding practices.

As CMS continues to evolve its regulatory framework, particularly in 2025, healthcare providers must remain vigilant and proactive in their compliance efforts. By implementing these strategies, including the use of Inferscience’s HCC Assistant, they can not only avoid penalties but also enhance their financial outcomes and ensure the sustainability of their operations in an increasingly competitive landscape.

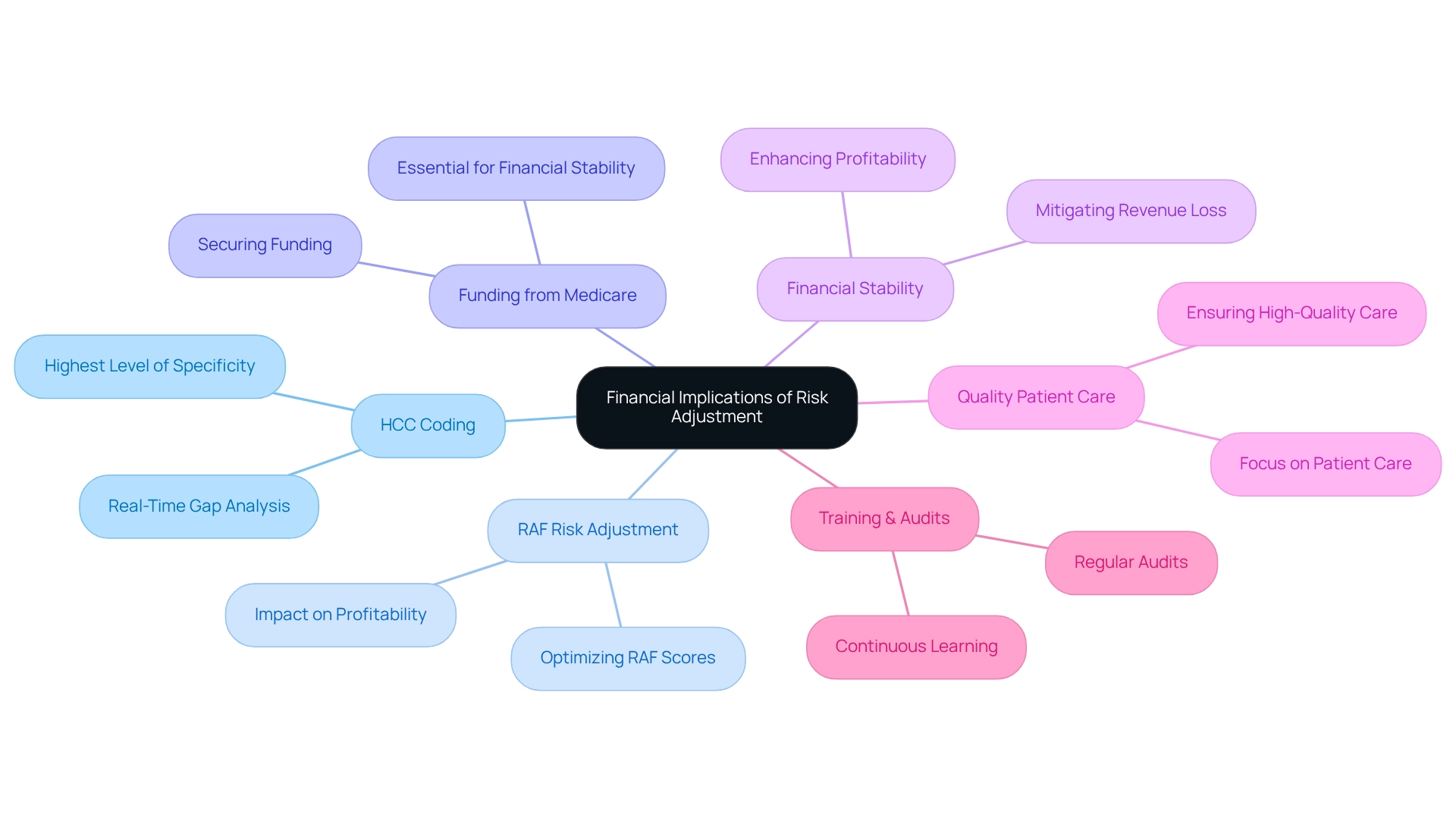

Hierarchical Condition Categories (HCCs) are pivotal in the adjustment process, categorizing individuals based on their health conditions and associated expenses. Each HCC corresponds to a specific risk score, which directly influences the overall RAF risk adjustment score for an individual. Accurate HCC classification is essential for healthcare organizations to accurately depict the health status of their clientele, thereby impacting the funding received from Medicare Advantage plans.

As of 2025, the number of HCC categories has expanded significantly, with recent updates subdividing HCC 75 into four distinct categories: 193, 194, 195, and 196. This significant change introduces additional complexity to programming practices, necessitating that providers remain vigilant about current guidelines and best practices.

Research demonstrates that the presence of multiple conditions can predict incrementally higher expenditures, underscoring the critical nature of precise HCC documentation. Organizations that fail to document the severity of their client populations with the utmost specificity may encounter insufficient reimbursement. This situation highlights the urgent need for meticulous documentation.

Inferscience’s Claims Assistant enhances this process by conducting a gap analysis on claims files, recommending HCC codes that may have been overlooked. By leveraging advanced AI and NLP tools, the Claims Assistant not only streamlines risk adjustment workflows but also consolidates patient data, ensuring precise classification. Real-world examples illustrate that accurate HCC classification can significantly elevate RAF risk adjustment scores, leading to improved financial outcomes for medical providers. For instance, a medical organization that implemented stringent HCC practices experienced a 15% increase in their RAF risk adjustment scores, which led to substantial funding boosts. Furthermore, the recent revisions to the CMS-HCC model are expected to revolutionize how providers approach classification and reimbursement, making it imperative for organizations to adapt their strategies accordingly. In conclusion, the effective management of HCCs is crucial for compliance and maximizing funding opportunities in an increasingly intricate medical landscape. CFOs should consider utilizing advanced tools such as Inferscience’s Claims Assistant to navigate these complexities, ensuring accurate coding and optimal reimbursement. To discover how the Claims Assistant can benefit your organization, request a demo today.

Data analysis is essential for enhancing adjustment strategies within healthcare organizations. By meticulously analyzing client data, providers can uncover trends, identify care gaps, and pinpoint areas for improvement. Advanced analytics tools, such as Inferscience’s HCC Assistant, significantly enhance the precision of individual health predictions and facilitate targeted interventions that improve outcomes and optimize raf risk adjustment. Organizations employing a multidimensional strategy for assessment have experienced a 22% increase in predictive accuracy, a benefit driven by the HCC Assistant’s automated data collection and analysis capabilities.

Moreover, the integration of AI and natural language processing (NLP) tools can unify patient data from various sources, effectively eliminating data silos and streamlining raf risk adjustment workflows. This data-driven methodology not only bolsters coding accuracy but also fosters proactive care management, which is crucial for enhancing financial performance. As medical analytics increasingly becomes a core strategic capability, organizations leveraging these insights will gain a competitive edge, leading to improved health outcomes and reduced overall expenses. As Linnie Greene observes, ‘This can lead to better health outcomes and lower overall costs in the long term, encouraging preventive care and proactive management of chronic conditions.’

In regulated markets such as Medicare Advantage, adherence to adjustment mandates is critical for participation, as insurers must navigate these requirements to avoid penalties. By utilizing analytics to identify care gaps and employing advanced NLP tools, medical providers can ensure they deliver quality service while maximizing funding opportunities, with Inferscience’s solutions playing a pivotal role in the raf risk adjustment process. For instance, case studies have shown that medical organizations utilizing Inferscience’s HCC Assistant have effectively minimized data silos and enhanced their adjustment processes, thereby showcasing the practical advantages of these technologies.

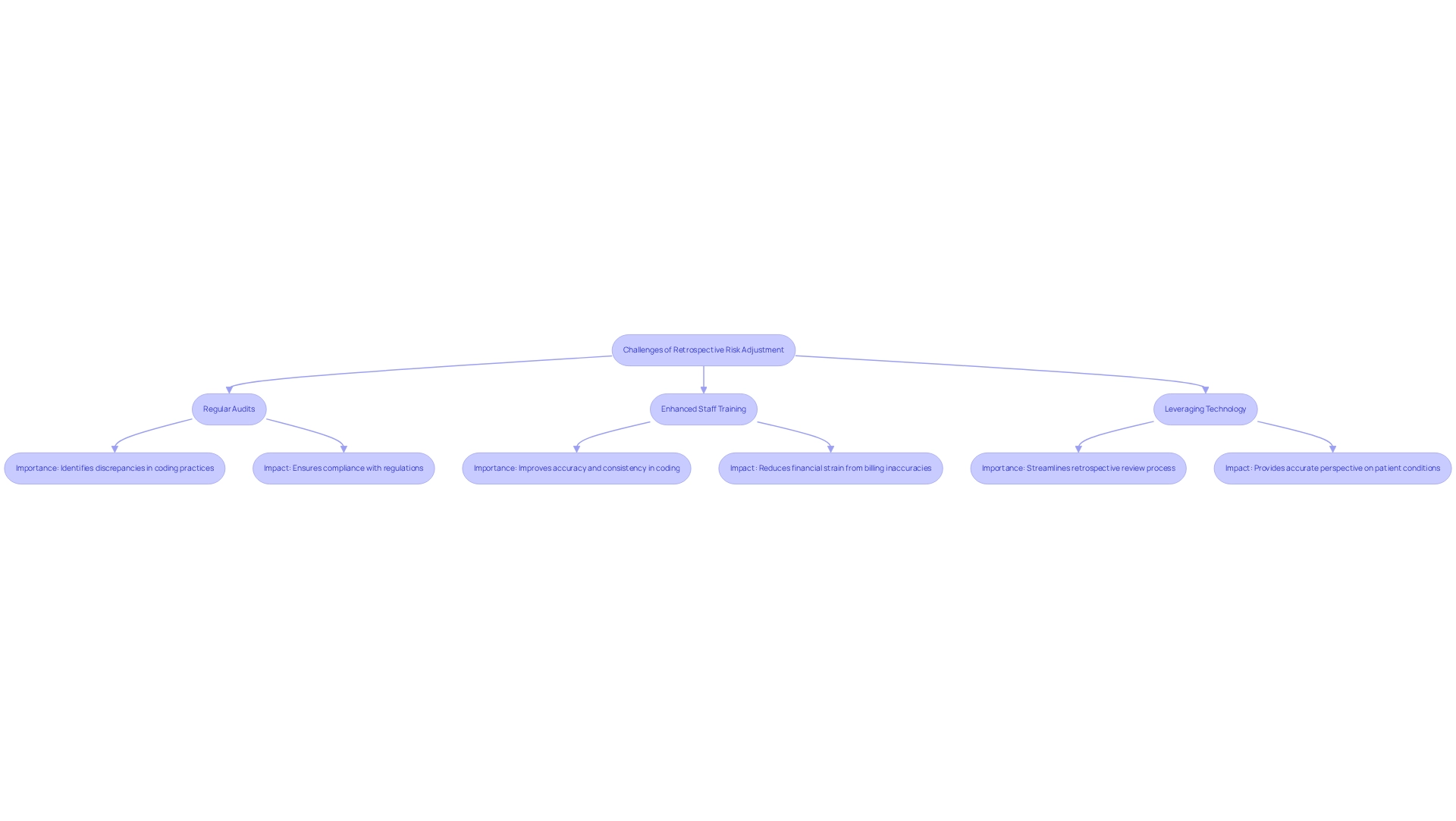

Retrospective risk adjustment presents significant challenges, particularly regarding the accuracy of historical data and the prevalence of classification errors. These issues can lead to substantial financial repercussions, including claim denials and cash flow disruptions, as healthcare providers face considerable financial strain from billing inaccuracies. To navigate these complexities, CFOs should implement several key strategies:

The HCC adjustment model, which utilizes hierarchical condition category (HCC) codes to calculate a patient-specific RAF risk adjustment score, is essential for determining the compensation healthcare organizations receive from Medicare Advantage plans. By proactively addressing these challenges, CFOs can enhance the accuracy of RAF risk adjustment processes, ultimately resulting in improved financial outcomes. The financial impact of programming errors cannot be overstated; organizations that adopt effective programming practices can mitigate risks associated with claim denials and ensure precise reimbursement. As emphasized by the Centers for Medicare & Medicaid Services (CMS), “The knowledge gained from this process guarantees precise reimbursement and enhances the overall data quality.” Furthermore, a recent case study demonstrated that organizations leveraging contemporary technology solutions, such as those offered by Inferscience, and prioritizing effective communication experienced a notable improvement in their coding accuracy, allowing them to concentrate on delivering high-quality care. This proactive strategy not only safeguards financial health but also aligns with the overarching goal of enhancing care within medical systems.

Prospective risk adjustment represents a proactive strategy that empowers healthcare organizations to foresee and manage risks to individuals before they adversely affect financial outcomes. By prioritizing preventive care and early intervention, providers can significantly enhance individual health while simultaneously lowering overall care costs. This methodology involves conducting regular assessments of individuals and utilizing predictive analytics to identify those at high risk. Applying these strategies not only enhances care quality but also improves RAF risk adjustment scores, ultimately resulting in greater funding from Medicare Advantage plans.

Inferscience’s HCC Assistant, relied upon by leading medical groups, employs advanced natural language processing (NLP) to integrate structured and unstructured data within electronic health records (EHRs). This integration helps locate overlooked health diagnoses, thereby improving RAF risk adjustment scores and ensuring providers receive maximum funding from Medicare Advantage contracts. The HCC Assistant greatly minimizes manual efforts in workflow processes, enabling providers to concentrate more on care for individuals.

Statistics indicate that precise documentation through prospective methods can enhance operational efficiency and patient care. This is crucial, given that the Centers for Medicare and Medicaid Services (CMS) currently reduces all plans’ payments by 5.91 percent as a documentation intensity adjustment. Incorrect coding can worsen financial difficulties for healthcare organizations, increasing the necessity for efficient adjustment strategies.

Moreover, case studies, such as the use of constrained regression to tackle undercompensation in adjustment models, demonstrate how advanced statistical techniques can enhance financial outcomes without creating negative incentives, thus directly supporting the proactive strategies mentioned. Healthcare leaders highlight the significance of these strategies, pointing out that improvements in statistical methods are crucial in boosting adjustment effectiveness, dependent on the quality of input data. Dr. McWilliams emphasizes that the effect of these advancements is greatly shaped by the data employed, reinforcing the importance of high-quality input in adjustment processes. By embracing a proactive approach to managing uncertainties, medical organizations can not only enhance their financial viability but also provide improved care to their client groups.

The integration of technology into adjustment processes is revolutionizing how healthcare organizations handle classification and reimbursement. Advanced software solutions, such as the Inferscience HCC Assistant, evaluate both structured and unstructured data from medical charts, providing relevant HCC recommendations directly at the point of care. By leveraging artificial intelligence and natural language processing, the HCC Assistant streamlines risk adjustment workflows, mitigates human error, and enhances accuracy, allowing users to effortlessly submit codes back to the assessment and plan section of the EHR. This automation of data collection and analysis significantly alleviates the administrative burden on medical providers, enabling them to concentrate more on patient care.

Furthermore, technology facilitates real-time monitoring of programming practices, which is vital for ensuring compliance and optimizing raf risk adjustment scores. Accurate HCC documentation is essential for enhancing these scores, ultimately improving financial outcomes and aligning with broader governmental initiatives aimed at digitizing health service delivery. Notably, while 57% of participants expressed concern that their relationship with their medical provider may diminish due to AI, the potential for AI to save governments millions or even billions of dollars in healthcare expenditures is undeniable.

Consequently, organizations can anticipate enhanced efficiency and accuracy in their coding processes, leading to improved resource allocation and financial performance. Moreover, insights from industry leaders underscore the importance of embracing these technologies to navigate the evolving landscape of medical care.

Effective financial modification significantly impacts healthcare organizations’ economic landscape. By accurately capturing individual risk through Hierarchical Condition Category (HCC) coding and optimizing RAF risk adjustment scores, providers can secure essential funding from Medicare Advantage plans. Inferscience’s Claims Assistant plays a crucial role in this process, conducting real-time gap analysis on claims data and recommending missed HCC codes that may have been billed by other providers or the individual’s primary care provider in the previous calendar year. This proactive approach ensures that all suitable codes are submitted, providing plans and Medicare with a more precise view of the patient’s condition and expected medical costs.

This funding is vital for maintaining financial stability and ensuring the provision of high-quality patient care. Organizations that excel in uncertainty adjustment not only mitigate revenue loss but also enhance their overall profitability. For instance, a commitment to regular audits and comprehensive staff training can significantly improve accuracy and compliance, ultimately optimizing financial results in an increasingly competitive healthcare environment. With 24 years of experience in programming services, Mark emphasizes that precision in programming is essential for achieving accurate adjustments, which directly influences profitability.

Moreover, Inferscience’s advanced HCC programming solutions, powered by AI and natural language processing, streamline workflows and enable providers to focus on patient care. Engaging YES consultants to train in-house teams on HCC practices underscores the importance of continuous learning. Real-world examples illustrate that healthcare organizations implementing effective RAF risk adjustment strategies witness substantial improvements in their financial performance, highlighting the necessity of prioritizing HCC coding within their operational frameworks. As we approach 2025, the financial implications of efficient adjustment will only intensify, making it imperative for CFOs to adopt these strategies to enhance profitability. Request a demonstration of the Claims Assistant today to discover how it can elevate your adjustment strategies.

CFOs play a pivotal role in managing RAF risk adjustment strategies that enhance financial performance. Key insights include:

By focusing on these areas, CFOs can position their organizations to thrive amidst the complexities of the evolving healthcare landscape.

Optimizing Risk Adjustment Factor (RAF) scores is paramount for healthcare organizations striving to enhance financial performance and ensure compliance within a competitive landscape. The Inferscience HCC Assistant stands out as a revolutionary tool, leveraging advanced technology to streamline coding processes, reduce administrative burdens, and enhance accuracy. By incorporating artificial intelligence and natural language processing, this innovative solution not only addresses data silos but also improves patient care outcomes through real-time coding suggestions and efficient data management.

The significance of understanding RAF scores and the critical nature of accurate Hierarchical Condition Category (HCC) coding cannot be overstated. As healthcare providers grapple with the challenges of regulatory compliance and the risk of financial penalties, utilizing tools like the HCC Assistant is essential. Regular audits, continuous training, and a proactive approach to risk assessment are vital strategies that CFOs can adopt to effectively navigate the complexities of risk adjustment.

In a time when technology is transforming healthcare, the integration of data analytics and automated solutions is at the forefront of optimizing risk adjustment strategies. By prioritizing accurate documentation and compliance, organizations can not only mitigate revenue leakage but also position themselves for enhanced financial outcomes and improved patient care. As the healthcare landscape continues to evolve, embracing these advanced technologies will be critical for maximizing profitability and sustaining high-quality care.